What You Should Know Before Opening an Offshore Trust

What You Should Know Before Opening an Offshore Trust

Blog Article

Discovering the Key Features of an Offshore Depend On for Riches Monitoring

Offshore depends on have obtained attention as a critical tool for riches administration. They supply distinct benefits such as property protection, tax optimization, and enhanced privacy. These trusts can be tailored to fulfill particular monetary objectives, safeguarding properties from potential threats. There are crucial factors to consider to maintain in mind - Offshore Trust. Comprehending the details of offshore trusts may expose greater than simply benefits; it could uncover potential obstacles that warrant cautious thought

Recognizing Offshore Trusts: A Primer

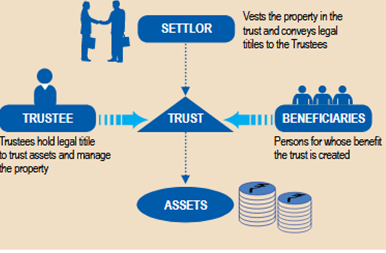

Overseas counts on may seem facility, they serve as useful monetary tools for individuals seeking to handle and protect their riches. An overseas trust is a lawful arrangement where an individual, referred to as the settlor, transfers properties to a trustee in a foreign territory. This structure enables enhanced privacy, as the information of the trust are not subject and typically personal to public scrutiny. Furthermore, overseas trust funds can offer versatility pertaining to asset administration, as trustees can be picked based upon proficiency and administrative advantages. They can additionally be customized to meet particular economic objectives, such as estate preparation or tax optimization. Comprehending the legal and tax ramifications of overseas trust funds is crucial, as policies differ substantially throughout various nations. Generally, these depends on supply a tactical method to wealth monitoring for those wanting to browse intricate economic landscapes while enjoying certain benefits that domestic trusts may not give.

Property Protection: Protecting Your Riches

Property protection is a crucial consideration for people looking for to safeguard their riches from possible lawful claims, creditors, or unanticipated monetary problems. Offshore trusts act as a tactical tool for achieving this goal, supplying a layer of safety and security that residential properties may do not have. By transferring properties into an offshore count on, people can develop a legal barrier between their wealth and potential complaintants, properly protecting these possessions from suits or personal bankruptcy proceedings.The jurisdiction of the overseas count on often plays a crucial duty, as many nations provide durable lawful structures that safeguard trust possessions from exterior claims. In addition, the anonymity provided by overseas trust funds can additionally deter creditors from going after insurance claims. It is vital for individuals to understand the certain laws regulating property security in their chosen jurisdiction, as this knowledge is essential for optimizing the effectiveness of their riches management approaches. Overall, overseas depends on stand for a proactive approach to maintaining wide range against uncertain economic difficulties.

Tax Obligation Benefits: Navigating the Fiscal Landscape

Offshore counts on use significant tax obligation advantages that can enhance riches administration approaches. They give chances for tax deferment, permitting possessions to expand without immediate tax ramifications. Additionally, these depends on might supply estate tax advantages, better maximizing the economic legacy for beneficiaries.

Tax Deferral Opportunities

Exactly how can individuals utilize offshore depend optimize tax deferral chances? Offshore depends on use a tactical method for delaying taxes on income and resources gains. By putting possessions in an offshore depend on, individuals can gain from jurisdictions with desirable tax obligation regimens, permitting prospective deferral of tax liabilities up until circulations are made. This device can be particularly useful for high-income income earners or investors with substantial resources gains. Furthermore, the revenue generated within the trust fund may not be subject to immediate taxes, allowing riches to grow without the problem of yearly tax responsibilities. Steering via the intricacies of worldwide tax legislations, people can properly use offshore depend boost their wealth management strategies while reducing tax direct exposure.

Estate Tax Benefits

Personal privacy and Privacy: Keeping Your Matters Discreet

Keeping privacy and privacy is crucial for people looking for to safeguard their wealth and assets. Offshore depends on supply a robust structure for safeguarding personal information from public examination. By establishing such a depend on, people can effectively separate their individual affairs from their monetary rate of interests, ensuring that delicate details stay undisclosed.The legal structures governing offshore depends on often provide strong privacy protections, making it tough for outside celebrations to gain access to details without approval. This level of privacy is particularly appealing to high-net-worth individuals concerned about possible dangers such as litigation or unwanted interest from creditors.Moreover, the discrete nature of offshore territories improves privacy, as these places typically impose rigorous laws bordering the disclosure of depend on details. Consequently, people can delight you can check here in the tranquility of mind that comes with knowing their economic approaches are shielded from open secret, therefore preserving their wanted level of discernment in riches monitoring.

Versatility and Control: Customizing Your Trust Structure

Offshore trust funds provide substantial versatility and control, enabling individuals to customize their count on frameworks to fulfill particular monetary and personal goals. This flexibility allows settlors to select various aspects such as the kind of assets held, distribution terms, and the consultation of trustees. By selecting trustees that straighten with their values and purposes, people can ensure that their wealth is managed according to their wishes.Additionally, overseas trusts can be structured to fit transforming scenarios, such as variations in economic needs or family members dynamics. This indicates that beneficiaries can receive distributions at defined periods or under certain conditions, giving additional modification. The capability to customize trust fund arrangements also guarantees that the trust fund can evolve in reaction to legal or tax modifications, preserving its performance with time. Eventually, this degree of versatility encourages individuals to develop a trust that lines up effortlessly with their lasting wealth monitoring strategies.

Potential Drawbacks: What to Consider

What obstacles might people encounter when taking into consideration an overseas count on for riches monitoring? While offshore depends on use numerous benefits, they likewise come with possible downsides that require mindful consideration. One substantial problem is the price connected with establishing and maintaining such a count on, which can include legal costs, trustee fees, and recurring administrative expenditures. In addition, people may experience intricate regulatory needs that differ by territory, potentially complicating conformity and resulting in fines if not adhered to properly. Offshore Trust.Moreover, there is a fundamental threat of money fluctuations, which can influence the value of the assets kept in the trust. Trust fund recipients may additionally deal with difficulties in accessing funds because of the management processes entailed. Public assumption and prospective analysis from tax obligation authorities can develop reputational risks. These aspects necessitate thorough study and professional support prior to waging an overseas depend on for riches monitoring

Trick Factors To Consider Before Establishing an Offshore Trust Fund

Prior to establishing an overseas depend on, individuals have to think about numerous vital elements that can substantially affect their wealth administration strategy. Legal territory ramifications can affect the count on's efficiency and compliance, while tax considerations might influence my site total benefits. A comprehensive understanding of these aspects is important for making educated decisions concerning offshore trust funds.

Legal Territory Implications

When considering the facility of an overseas count on, the selection of legal territory plays an essential role fit the depend on's effectiveness and protection. Different territories have varying regulations governing depends on, consisting of regulations on possession protection, privacy, and compliance with global criteria. A territory with a durable legal framework can enhance the depend on's legitimacy, while those with less rigorous laws may position risks. Additionally, the credibility of the selected territory can impact the depend on's perception amongst beneficiaries and financial establishments. It is important to assess variables such as political security, legal precedents, and the accessibility of experienced fiduciaries. Ultimately, selecting the best jurisdiction is necessary for attaining check my reference the wanted objectives of property defense and wide range management.

Taxes Considerations and Benefits

Taxation factors to consider significantly affect the decision to establish an offshore count on. Such counts on may offer substantial tax advantages, consisting of minimized earnings tax liability and potential estate tax obligation advantages. In lots of territories, revenue produced within the trust fund can be strained at lower rates or not in all if the recipients are non-residents. Additionally, properties held in an overseas trust might not undergo domestic estate tax, facilitating wealth preservation. It is important to navigate the complexities of international tax legislations to guarantee compliance and stay clear of risks, such as anti-avoidance policies. Individuals need to speak with tax obligation professionals experienced in overseas frameworks to maximize benefits while sticking to relevant laws and laws.

Frequently Asked Concerns

How Do I Choose the Right Territory for My Offshore Trust?

Selecting the appropriate jurisdiction for an overseas depend on includes examining factors such as legal security, tax obligation effects, regulatory environment, and personal privacy regulations. Each jurisdiction supplies distinct benefits that can considerably impact wealth monitoring approaches.

Can I Modification the Recipients of My Offshore Trust Later On?

The capacity to change recipients of an overseas depend on depends on the trust's terms and administrative legislations. Normally, several offshore trust funds permit adjustments, however it is necessary to seek advice from legal advice to assure compliance.

What Is the Minimum Quantity Needed to Establish an Offshore Depend On?

The minimum amount needed to establish an offshore count on differs considerably by territory and company. Normally, it ranges from $100,000 to $1 million, depending upon the intricacy of the trust fund and linked fees.

Exist Any Type Of Lawful Restrictions on Offshore Trust Fund Investments?

The legal limitations on overseas depend on financial investments differ by jurisdiction. Usually, guidelines may restrict particular asset kinds, impose coverage demands, or restrict transactions with particular countries, ensuring compliance with international regulations and anti-money laundering steps.

Just how Do I Dissolve an Offshore Trust if Needed?

To liquify an offshore trust, one have to adhere to the terms detailed in the count on deed, ensuring compliance with suitable legislations. Legal recommendations is usually suggested to navigate possible intricacies and determine all responsibilities are met. By moving possessions into an overseas count on, people can create a lawful barrier in between their wealth and prospective plaintiffs, effectively shielding these possessions from lawsuits or personal bankruptcy proceedings.The jurisdiction of the offshore trust fund often plays a crucial function, as several countries offer robust lawful frameworks that protect depend on possessions from outside claims. By establishing such a depend on, people can successfully divide their personal affairs from their economic passions, making certain that sensitive details remain undisclosed.The legal frameworks regulating offshore trusts usually supply solid privacy securities, making it hard for external celebrations to accessibility details without approval. Offshore trusts supply substantial adaptability and control, allowing individuals to tailor their trust fund frameworks to meet particular monetary and personal objectives. When taking into consideration the facility of an overseas trust fund, the selection of legal territory plays a pivotal function in shaping the trust's performance and safety. The capacity to change beneficiaries of an offshore depend on depends on the trust fund's terms and administrative regulations.

Report this page